NVDIA did wonders last week and managed to lift the stock market despite the slight kick back down Friday before the

close.

Having as well more optimistic growth data pouring in continuous positive flow into the market.

But currently we are finally near a major level where a pullback can be finally expected. Now the main thing to look

forward to, that can amplify our view on whether this pullback will be sustainable and will give us the opportunity

to build sell orders for the mid-term will be USOil short term performance.

As it’s recent volatility will give us more indication on what the markets will be pricing in as growth or fear.

Let’s first take a look at the correlation coefficient between Nasdaq as example and USOIL. Showing us a trend of positive correlation unfolding at the moment.

Hence, if oil will manage to break above this supply area showcased in the chart below we can then, expect that the stock market will do the following and the downside move that is happening now to be short lived.

On the opposite side any significant bearish movement seen in the Oil market will have consequence and direct repercussion seen in the stock market, where then building up on bearish bias will be highly possible.

Now let’s also assess the market from a technical perspective while highlighting our key points.

Our charts of focus will also be Nasdaq:

We won’t be directly writing our key numbers, as price could face some changes between brokers, spot & futures.

So make sure to highlight these areas on your chart as well.

Anyhow our expected scenario (despite awaiting Oil’s move):

As long as we remain below Friday’s high we are more tilted to the downside.

The first targeted area will be the white demand, but small support before at the red zone where the breakout happened.

If any break happens below the first white zone then, additional downside should be expected.

Note: No action should be taken near our key area before at least basic confirmation, taking for example an hourly bullish candle near white zones.

Anyhow, as a new week of trading will be starting bare in mind that markets shift are being imminent and highly volatile, to remain updated for our bias keep a close look at our discord servers!

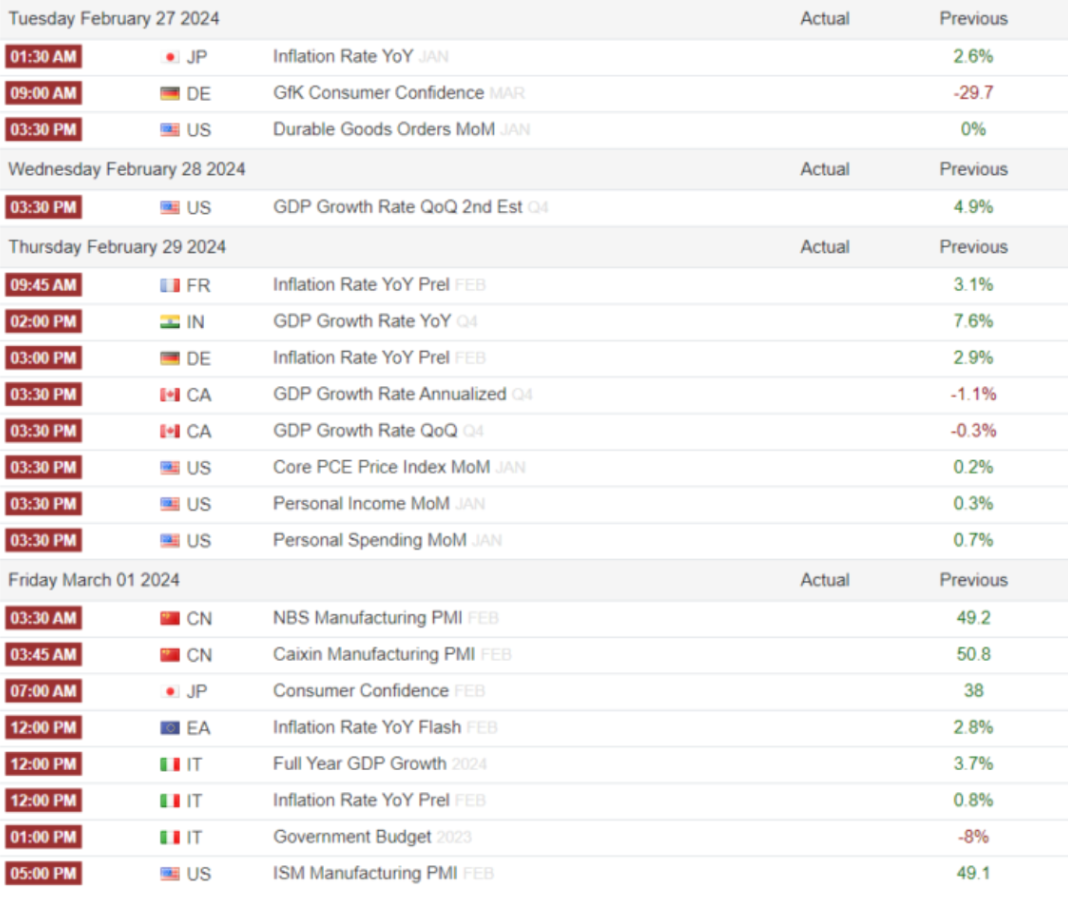

And here we will be concluding .a snapshot of key data to watch for in the upcoming week

Take your trading to the next level with our insights

reviews showed that more than 75% of subscribers make back their money within 3 days